GameFi Tokenomics 101: Single-token blockchain games

PART ONE:

Learn what is GamFi and GameFi Tokenomics and how GameFi play-to-earn crypto games work. Here we explain everything you need to know about GameFi crypto games in 2022.

As an emerging industry, GameFi requires participants to ask many questions about projects before investing. Chief among these are questions about tokenomic models.

COVER ART/ILLUSTRATION VIA CRYPTOSLATE

As an emerging industry, GameFi requires participants to ask many questions about projects before investing. Chief among these are questions about tokenomic models.

Tokenomics refers to the structure of a project’s economics and value system. At its core, tokenomics governs the relationship between NFTs and tokens within the game.

Footprint Analytics also provides dashboards for users to check the tokenomic of a specific game and the token holders’ analysis including daily active holders, new holders, and top 10 token holders.

In this article, we will be looking at single-token games and the ways they organize value. We will also explain the best way to profit from each of these models with the least risk.

3 Tokenomics Models for Games with One Token Only

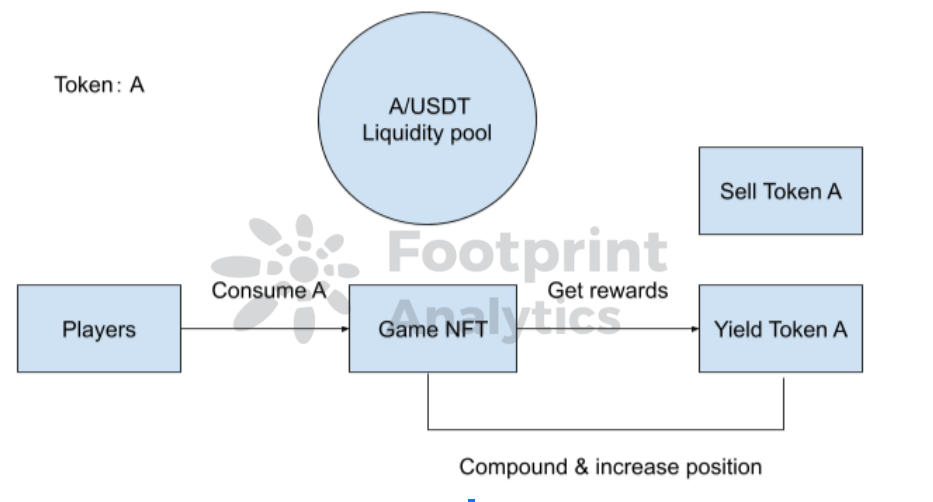

Single-token GameFi projects have just one token that supports all economic roles. Some examples include Crypto Zoon, Playvalkyr, Hashland, and Radio Caca.

This model requires a constant stream of new players to enter or repeat investment from former players, that is, to achieve 100% external circulation.

The single-token model can further be broken down by the relationship between the game token and fiat.

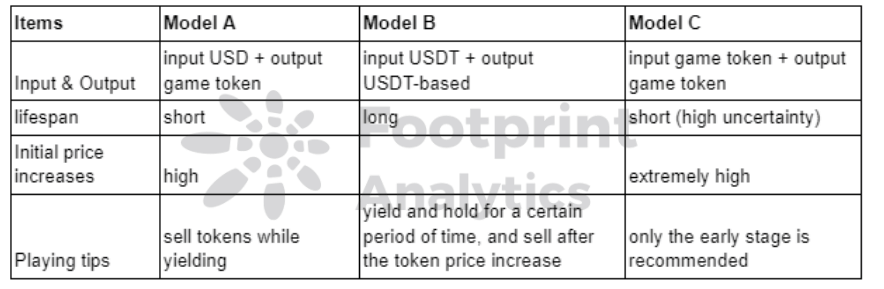

Model A: Input USD + output game token

This model was common at the beginning of the GameFi boom in 2021, in which users use USDT or BNB to buy NFTs and play to earn game tokens. This method is also widely adopted in DeFi yield farming.

The feature of this model is that the entry price is fixed and the earning fluctuates with the token price.

The payback period will decrease as the toke price rises if the token is in an uptrend. This model can create a strong FOMO effect once a positive spiral starts around the project.

However, it also amplifies the output and consumption of the tokens, easily causing an irreversible death spiral. Once the token reaches a downward trend, a rug-pull will happen in a degen project, while a solid project has to keep using real money to support the market and release good news to attract new players.

Most pull-rug projects love to use this model—get real money and give minted tokens to the players.

This model is prone to fast initial runs and has a short lifespan. It is recommended that players sell tokens while yielding. Once the price decline trend appears, sell the token immediately.

Model B: Input USD + output USD value-based

To counteract the constant threat of an irreversible falling knife inherent in the first model of single-token games, a more recent type of game emerged where the token is always tied to USD value. For example, if the game is assumed to yield 100 USDT/Day, the number of tokens will change according to the token price. If the token price is 1 USDT today, the player gets 100 tokens. If the token price becomes 0.5 USDT tomorrow, the player receives 200 tokens.

This model enables fixed costs and returns for the players. In the upward trend of token price, the return cycle remains stable due to the decrease of the corresponding output quantity. In contrast, in the downward trend, the daily USDT-based returns obtained by the player are constant for a short period.

But is it too good to be true? Model B generally sets a lock-up period. The token price after 7 days may not be 0.5 USDT.

Valkyrio is a typical Model B project. The game itself is not fancy but quickly attracted a lot of new users within two weeks after the launch and the token price saw rapid growth, attributed to the new token model and the GameFi boom.

Income is stable and projects have longer lifespans. Token prices under this model tend to resist sudden surges and plunges. It is recommended that players yield and hold for a certain time and sell after the token price increases to obtain more income. After seeing a slowdown in new players, sell the tokens immediately.

Model C: Input game token + output game token

In projects with Model C tokenomics, the cost and returns are both highly correlated to the token price.

For example, a game requires 100 tokens to play and provides a return of 10 tokens per day. The cost and returns will fluctuate from 100 USDT and 10 USDT to 200 USDT and 20 USDT if the token price grows from 1 USDT to 2 USDT.

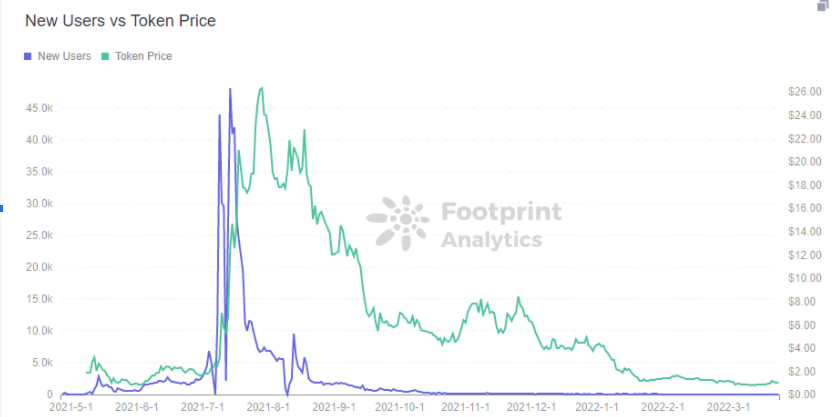

RACA (Radio Caca) is an example of this model. It is the exclusive manager of Maye Musk Mystery Box (MPB) NFT. Maye Musk, who is Elon Musk’s mother, and Binance’s founder Changpeng Zhao, held an AMA for this project, drawing a steady stream of players.

As more players join, the prices surge, starting a FOMO cycle. Early players benefit from the dividends of rising token prices and draw revenue from the high cost of new players. Many projects that apply this model make a fortune overnight.

Token prices are prone to spikes and drops. These types of projects have a short lifespan unless they can retain a large user base. It is recommended only to join at an early stage and keep an eye on the ability of the game to attract new users.

Summary

While many people label games as single or multi-token, these categories appear quite broad once you study GameFi data. Even among single-token games, there are several tokenomics models, each of which has its own distinct traits and dangers.

This was an article originally by Watermelon Game Guild, edited by Footprint Analytics then reprinted by GameFiRising.com.

Before we move on to GameFi P2E explained part two, here is another GameFi project you might be interested in…it’s called Ertha and it is a two-way portal for NFTs to travel between metaverses, The concept of this metaverse is to build a new world to avoid extinction. It’s very similar to the real world. You can own NFT land, real estate, companies, and more to generate lifetime revenue. You can also hire in-game experts to maximize your global sphere of influence. Ertha is a real-world simulation and a player-driven economy with wars and politics. CHECK IT OUT!

Gamefi Play-to-Earn Crypto Explained 2022

PART TWO

GameFi Tokenomics 101: Dual-token blockchain games

In this part two: we will cover dual-token projects, the most popular model for GameFi today

COVER ART/ILLUSTRATION VIA CRYPTOSLATE

In part one, we introduced three tokenomic models for single-token blockchain games and their respective pros and cons.

In this article, we’ll go over dual-token projects, an innovation that came after single-token games, which is the most popular model today.

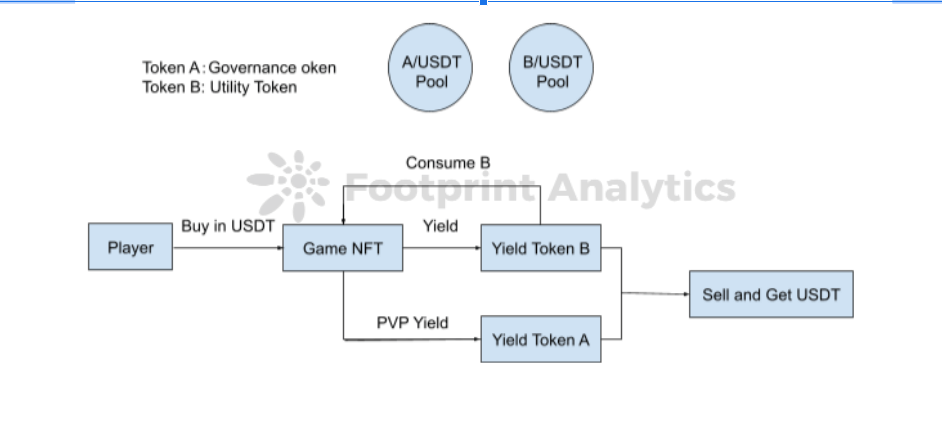

The dual-token model emerged in the first half of 2020 when Axie Infinity introduced SLP (Smooth Love Potion) to reduce selling pressure on AXS, the original game token of Axie Infinity.

Since then, almost all major titles have had a dual-token economy.

To understand how dual-token games work and why this model exists, we should look at how Axie rolled out SLP.

Before introducing SLP, Axie was a single-token GameFi, where players input USD and receive the game token, AXS. With tremendous user growth and money from many PE funds supporting the market, Axie successfully ran on just one token for over a year.

However, it was not difficult for Axie to realize how critical new users were for the projects. Once new money stopped coming in, a death spiral would begin.

To alleviate selling pressure on AXS, Axie introduced SLP in 2020. Whereas AXS was used for governance and staking rewards, players would use in-game utility token SLP for breeding new Axies and earning more SLP. The development team increased the ratio of $AXS- $SLP required for breeding and increased the amount of $SLP needed for reproduction.

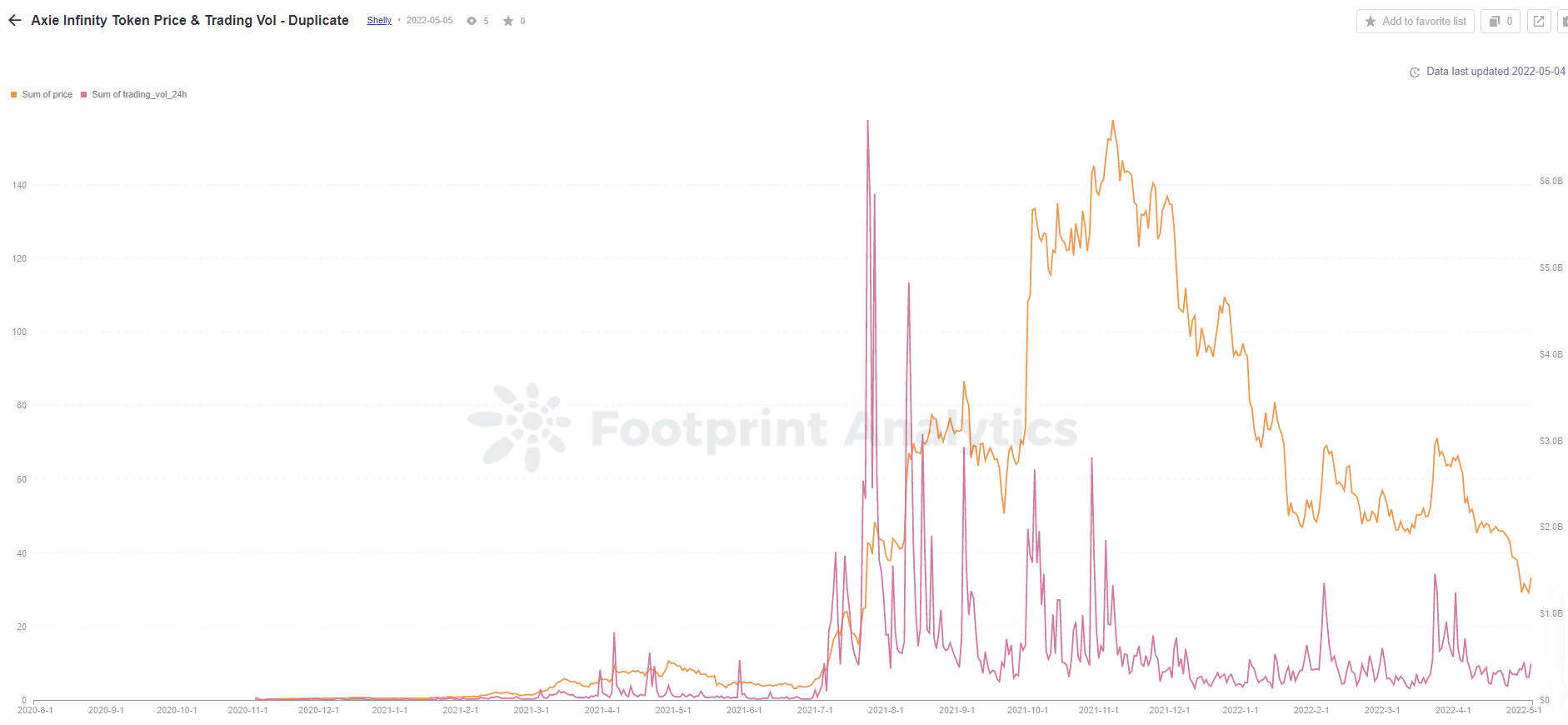

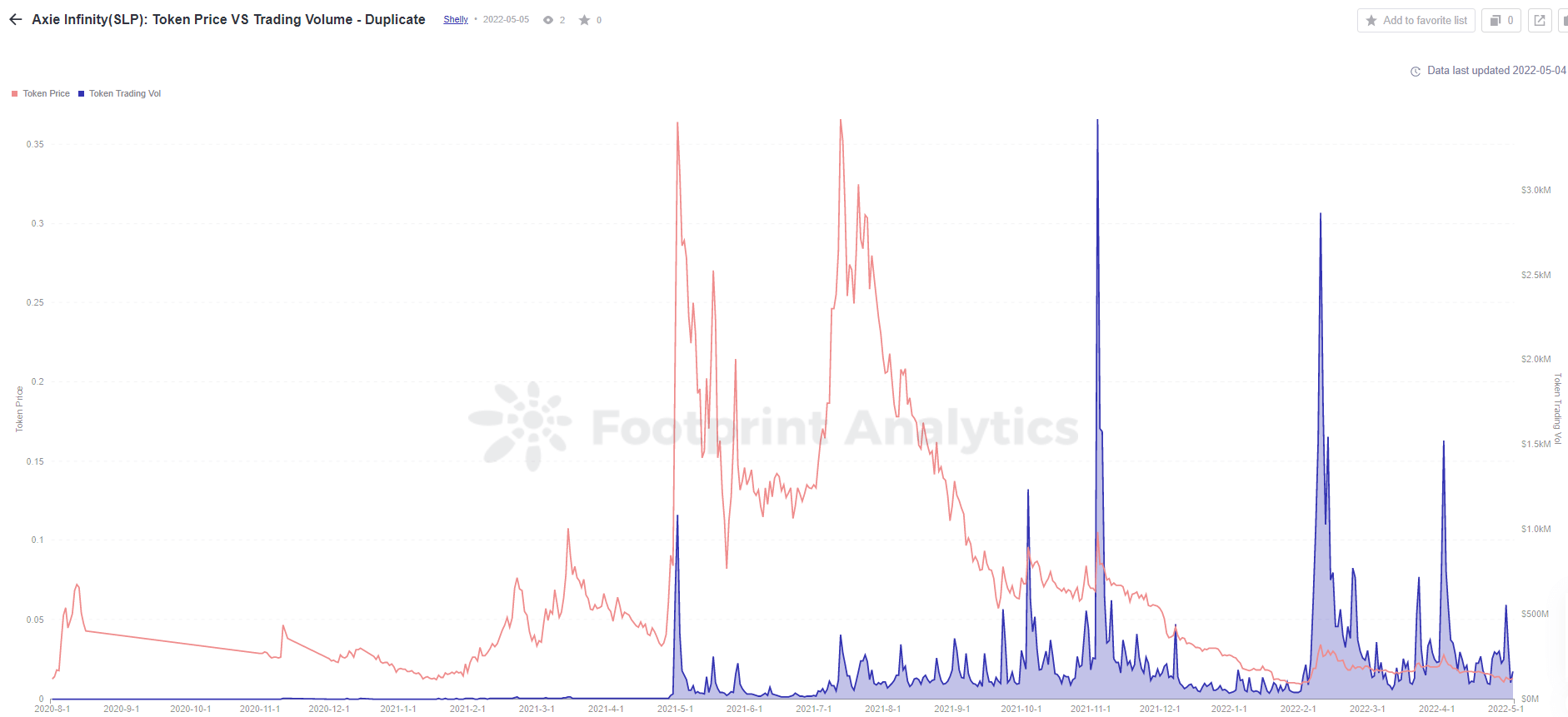

At first, the new model worked as planned. According to Footprint Analytics, AXS’s price roared right after SLP was brought to the game, while SLP’s token price stood below $0.1 for several months. SLP had seen an uptrend drawn by newcomers since the GameFi summer.

However, this trend did not last long, and SLP soon fell into a death spiral. The Axie team responded by changing the community governance structure to become more decentralized. They also removed SLP as the game’s PVE (Player vs. Environment) yielded earnings on Feb. 9 to reduce SLPs mint and supply. With these changes, SLP’s price increased.

The dual-token model has solidified wherein one token is mainly used for governance—owning more of this allows the holder to have more voting power in community votes about the project—and another is used for in-game functions, i.e., the utility token. In most games today, players earn most of the yield in the usually lesser valued utility coin and a bit in the governance coin as a premium, e.g., if they own valuable NFTs.

Besides Axie, several other popular GameFi projects, such as BinaryX and Starsharks, also use the dual-token model.

Two different categories of dual tokens GameFi

Most of the newly released dual-token GameFi projects adopt the model of the “input game token and output game token” model.

For example, BinaryX players use governance tokens to start the game and yield utility tokens as returns, while Starsharks players start and yield utility tokens in the game.

We know from the previous article that the cost and returns are highly correlated to this model’s token price. It is much easier to adjust the tokenomic models without centralized adjustment with the dual tokens than the USD value-based model. The USD-based model requires an oracle to specify the number of corresponding tokens, which complicates the dual-token model.

In this article, we provide an analytical approach to dividing different categories of dual tokens GameFi: After the sale of Genesis NFT, what approach does the project owner use to increase the number of NFTs in the market to meet the demand for NFTs from new players?

In the beginning, most of the GameFi projects will sell Genesis NFT on the official platform or partner platforms such as Binance NFT or Opensea to accumulate initial players. They then have several mechanisms to mint further NFTs while fuelling token consumption. These include:

- Breeding Model: In this model, the second generation NFTs and subsequent NFTs come from the breeding of Genesis NFTs, with no more blind boxes sold. This mechanism requires burning/spending tokens to mint the new NFTs, which allows the game to influence the selling pressure on the tokens depending on the price of minting.

- Blind Box Model: Compared with the breeding model, the blind box is simple. The team sets the number of NFTs in the game, and when the market is good, or consumption goes up, players sell more. This buoys the price of the tokens because they need them to buy the NFTs.

However, all ambitious, long-view projects will declare that most of the money from blind box sales, whether in USDT or utility tokens, goes straight to the community treasury or burnt. Starsharks is so popular because it announced to burn 90% of the utility tokens from blind box sales.

Summary of dual-tokens GameFi tokenomics

Tokenomics are a crucial part of a GameFi project, along with metrics like the number of new players, the number of active players, and the contrast between output and consumption.

As GameFi evolves, each cycle sees new economic models and innovations, each with its own pros and cons. Serious investors can also learn to spot trends within specific tokenomic models to time bottoms, predict FOMO inflation, generate yield during bottom stabilization, and other strategies.

An article originally by Watermelon Game Guild, edited by Footprint Analytics community then reprinted by GameFiRising.com.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that GameFiRising believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and GameFiRising expressly disclaims any liability for the accuracy and completeness of the information contained in this website. Additionally, the information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party, and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high-risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.